Housing slumped again and the Leading Economic Indicator Index plunged for a third straight month, but the consensus forecast of leading economists is for no recession.

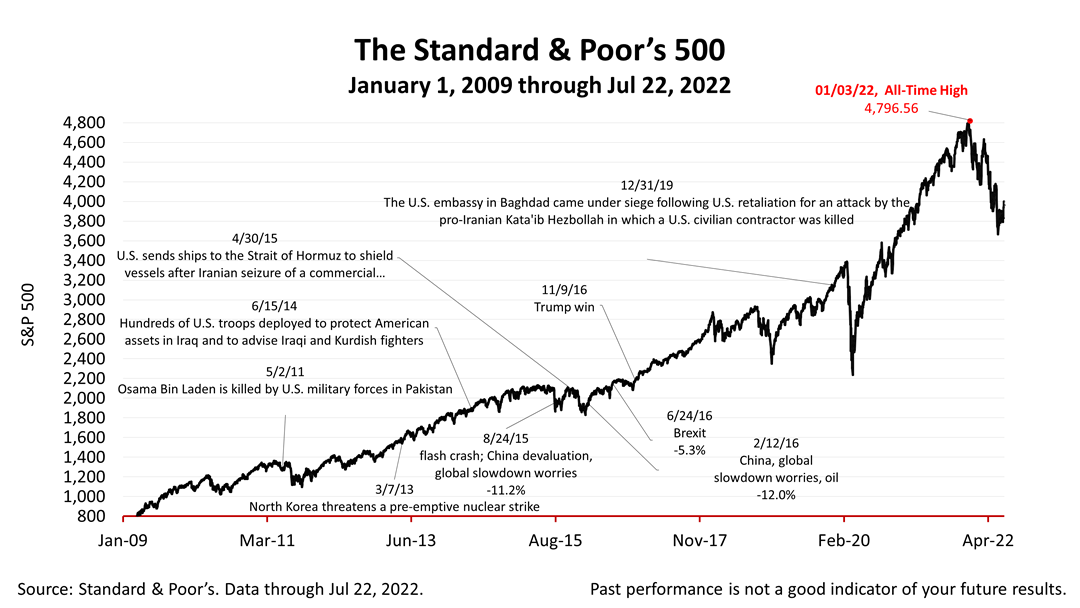

The economy remains on the edge of a recession but the stock market this past week acted like the worst of the bear market may be over.

Housing starts dropped for a second straight month. However, permits to start construction of a new single-family home are “holding up,” according to independent economist Fritz Meyer,

Housing starts for many years have remained much lower than the projected rate of 1.6 to 1.8 million consistent with long-term demographics and the replacement of the existing housing stock, according to Jonathan Spader, Daniel McCue, and Chris Herbert of the Joint Center for Housing Studies at Harvard University.

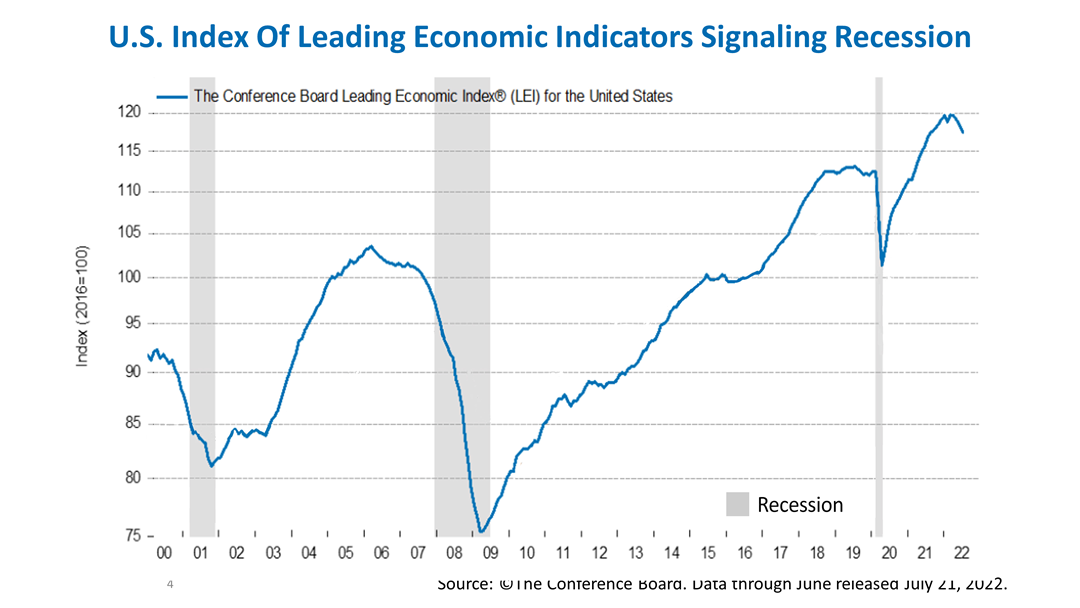

The LEI plunged before every recession in modern financial history except for the Covid-19 recession. In the last three months, the LEI dropped -0.8% in June, -0.6% in May, and -0.3% in April.

The three-month plunge prompted an about-face in the outlook for the U.S. from The Conference Board, a big-business group, that has calculated the LEI’s 10 sub-component indexes monthly for many decades.

Only last month, The Conference Board economics team predicted +2.3% US GDP growth in 2022. In a turnabout, “US recession around the end of this year and early next is now likely,” said Ataman Ozyildirim, who leads the economics team at The Conference Board, said in a July 21 forecast :

The Conference Board Leading Economic Index® (LEI) components:

1) average weekly hours worked, manufacturing

2) average weekly initial unemployment claims

3) manufacturers’ new orders – consumer goods and materials

4) ISM index of new orders

5) manufacturers’ new orders, nondefense capital goods

6) building permits, new private housing units

7) stock prices, S&P 500

8) Leading Credit Index™

9) interest rate spread 10-year Treasury minus fed funds

10) index of consumer expectations.

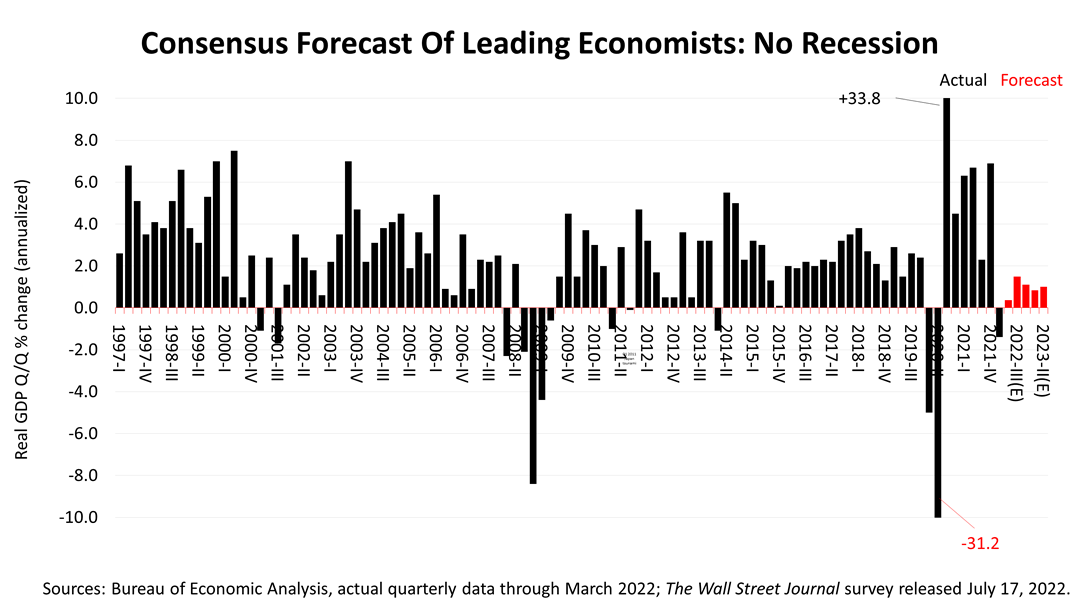

The Wall Street Journal’s quarterly survey of 60 economists projects that the economy will continue to grow for the five quarters through September 2023. They do not expect a recession.

The Standard & Poor’s 500 stock index closed this Friday at 3,961.63. The index lost -0.93% from Thursday but shot +2.52% higher from last week. The S&P 500 index is up +55.62% from the March 23, 2020, bear market low. On June 13, 2022, the S&P 500 dropped more than 20% from its January 3rd all-time high. Down about -17% from its high on a price-only basis, the bear market may have bottomed. No one can predict the next near-term market surge or plunge, but the stock market is a leading economic indicator.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.

Schedule a FREE Consultation Today!

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.