What To Do Now To Build Wealth

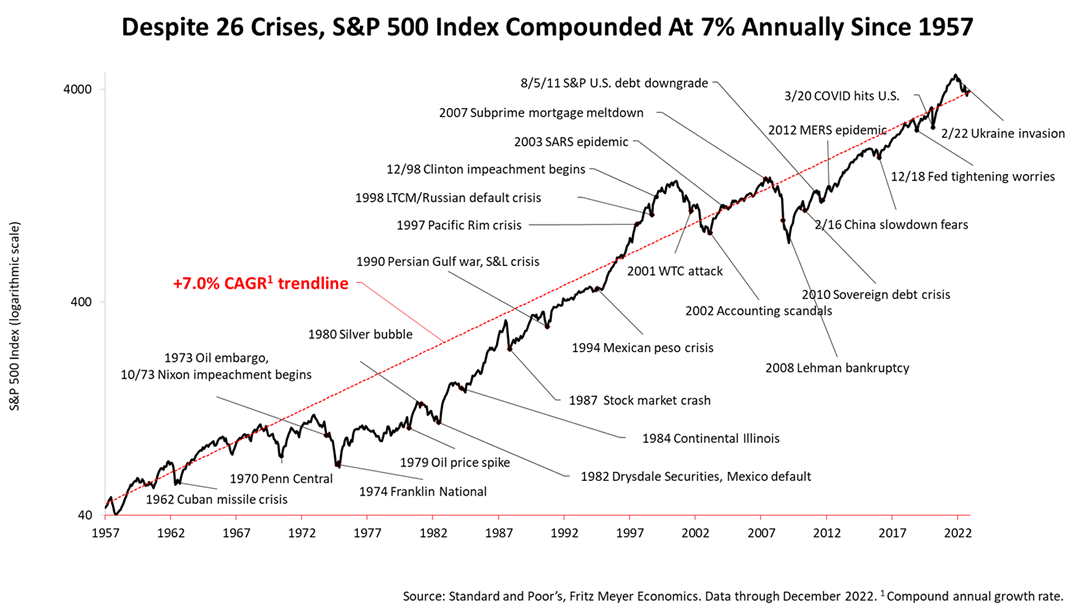

With the investment outlook uncertain, as it is almost always, this chart is a reminder that crises have come and gone throughout modern history and $1 invested in the U.S stock market, as measured by the Standard & Poor’s 500 stock index, compounded at an annualized rate of 7% for 65 years ended December 31, 2022.

While the stock market’s unpredictable in the near term, don’t let it be a distraction from another important wealth-building topic: A smart thing to do at this moment is to determine how to take advantage of the newly enacted SECURE Act 2.0 in 2023. This new reform to retirement tax law affects Americans of all income and age groups.

The new law, commonly called SECURE 2.0, was actually titled by Congress, “The Securing a Strong Retirement Act 2.0.” SECURE 2.0 expands on the Setting Every Community Up For Retirement Enhancement (SECURE) Act signed by President Donald Trump in December 2019. SECURE 2.0 is part of a massive government spending bill, the $1.7 trillion Consolidated Appropriations Act of 2023. The 4,155-page bill funds the federal government through September 30, 2023, and contains provisions addressing numerous national financial priorities, such as aid to Ukraine, and funding federal disaster relief as well as retirement funding. Some of the new rules on retirement became effective as of January 1st 2023, while others will not kick in for many years.

In a complex world, this article is not advice but presents facts, analysis, and uncommon financial knowledge for educational purposes.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.