Let’s Talk About Stock Market Volatility

Let’s talk about stock market volatility because we have seen some extraordinary volatility lately. Let’s start by recalling the basic axiom of investing in common stocks: If you want the so-called equity risk premium, then you should expect stock market volatility and, in fact, welcome it. It’s completely counterintuitive.

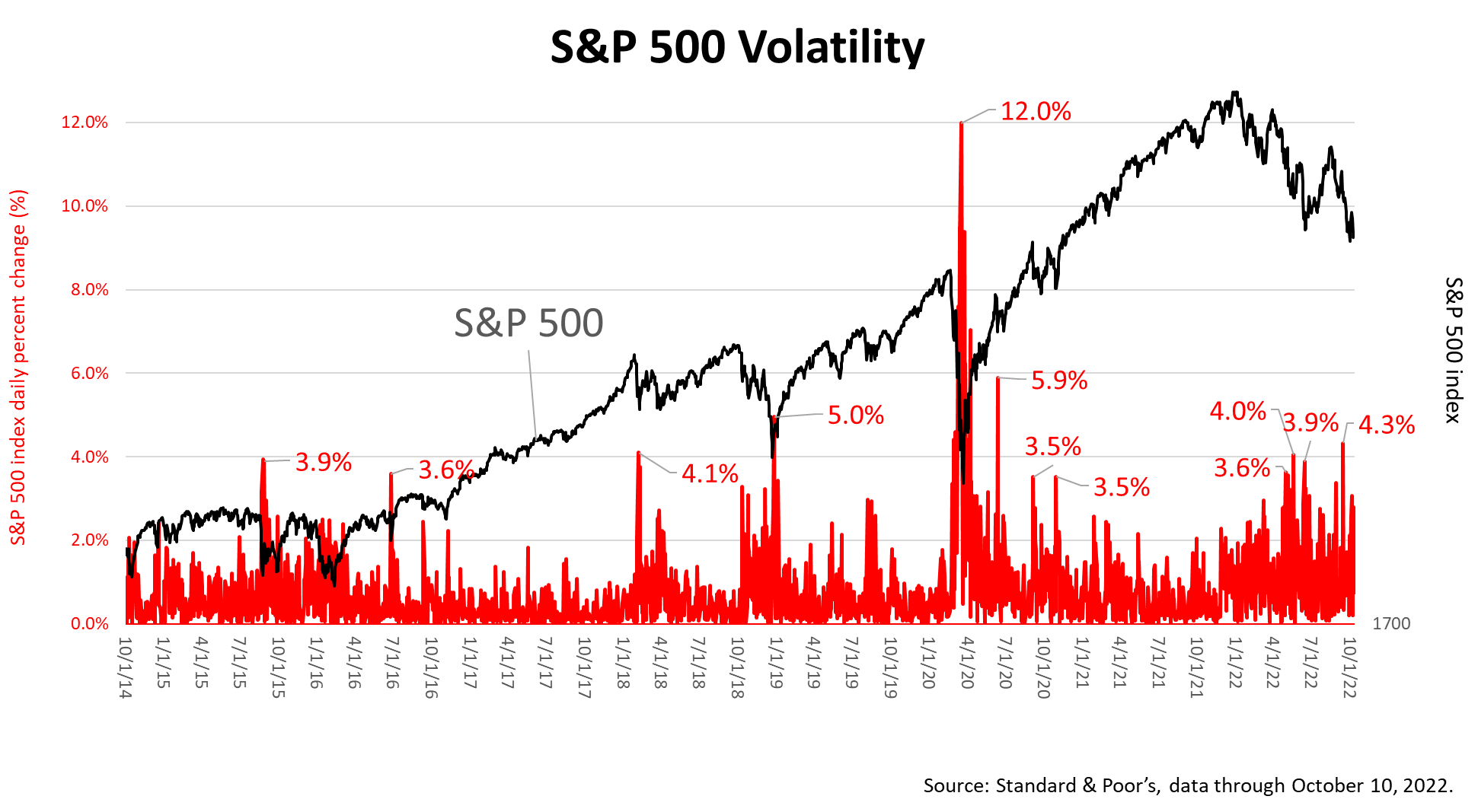

Without volatility, you wouldn’t get the excess return over fixed income on common stocks. Yes, we’ve entered a period of heightened volatility, as is shown in this chart. Volatility is much higher than before the pandemic. Spikes of 3% in the S&P 500 have occurred more often since Covid-19 struck, as shown in this chart.

We experienced a period of low volatility for much of 2021. However, in recent months, stock price volatility surged. What’s difficult is understanding why investors should be happy when stocks periodically shed value sharply. Otherwise, the long-term returns on stocks would not make financial sense. This is why a risky investment like stocks paid a premium over U.S. Government guaranteed fixed-income securities.

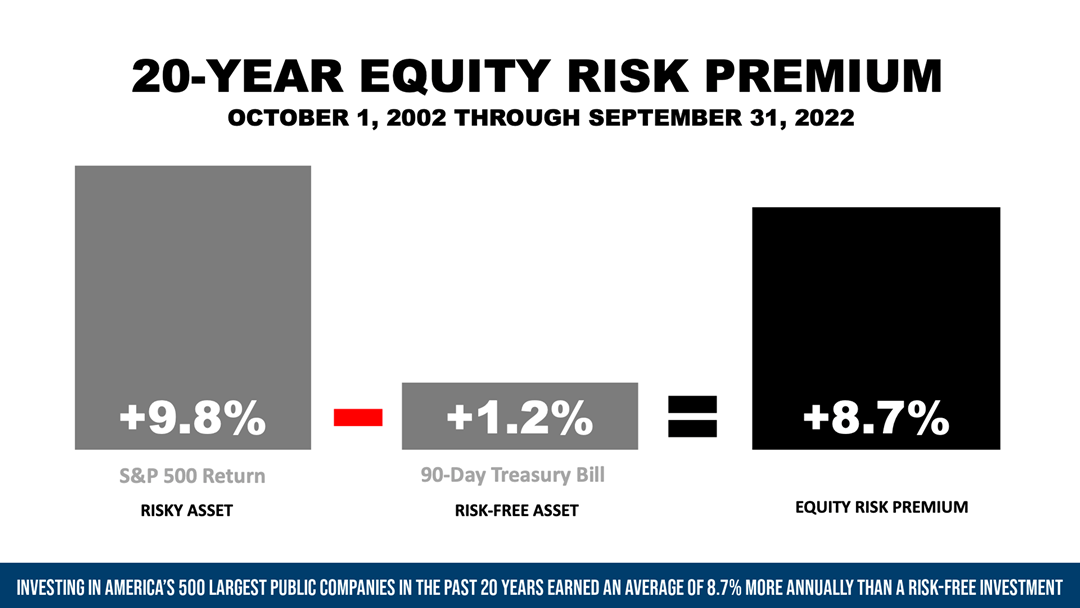

Subtracting the annual return on government-backed U.S. Treasury bills from the return on the Standard & Poor’s 500 index, the resulting 8.7% is the premium paid annually for taking the risk of owning U.S. stocks over 20 years.

To be clear, investing in America’s 500 largest publicly held companies in the past 20 years ended September 31, 2022, earned an average of 8.7% more annually than a risk-free investment. Investors were paid a premium for many generations for owning U.S. stocks, which are risky.

Amid a bear market that is not expected to end while the Federal Reserve is still raising lending rates to slow the economy, which will put people out of work and tamp down inflation, try to be happy about it.

Do you have questions about stock market volatility or any other aspect of tax and financial planning?

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and wellbeing for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.