Why Stocks Broke The All-Time Record High

Throughout most of 2023, the economy and stock market kept surprising economists and investors, repeatedly outperforming expectations, and 2024 is starting out by showing much the same pattern.

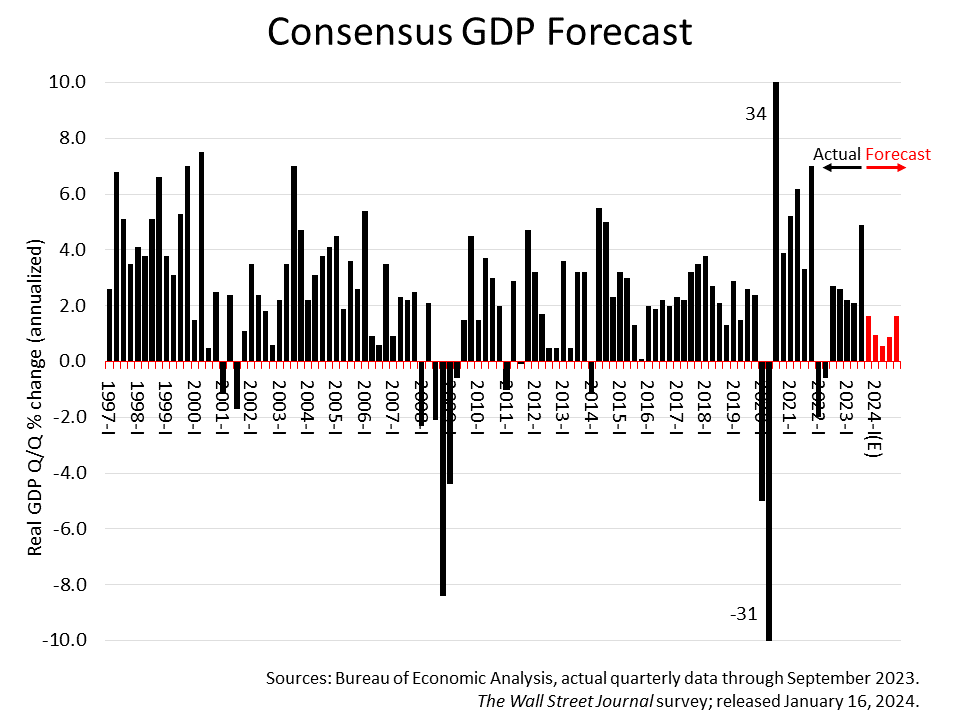

In early January, the 60 economists surveyed quarterly by The Wall Street Journal predicted a slowdown ahead, expecting the fourth quarter 2023 U.S. economic growth rate will come in at 1.65%, slow to 0.94% in the first quarter of 2024, and eke out a 0.55% growth rate in the second quarter before rebounding in the second half of this year.

Despite the tepid consensus forecast by leading economists, the stock market broke a record Friday by closing at a new all-time high price, and algorithmic-driven forecasts by the Federal Reserve Bank branches in Atlanta and New York are again predicting much higher forecasts than the consensus of leading economists.

The GDPNow forecast from the Atlanta Fed, powered by an algorithm that’s updated as new economic data comes in throughout every quarter, was released on Thursday and predicted at 2.4% growth rate in the fourth quarter of 2023. That’s much higher than the consensus forecast in The Journal as well as the Blue Chip Financial Forecasts survey of economists. In addition, the New York Fed’s Nowcast, which is based on an algorithm its staff developed independently, on Friday was also forecasting a 2.4% growth rate for the final quarter of 2023.

Since the pandemic struck the U.S. in early 2020, the Federal Reserve branch algorithmic-powered forecasts have been far more accurate in predicting the growth rate of the economy.

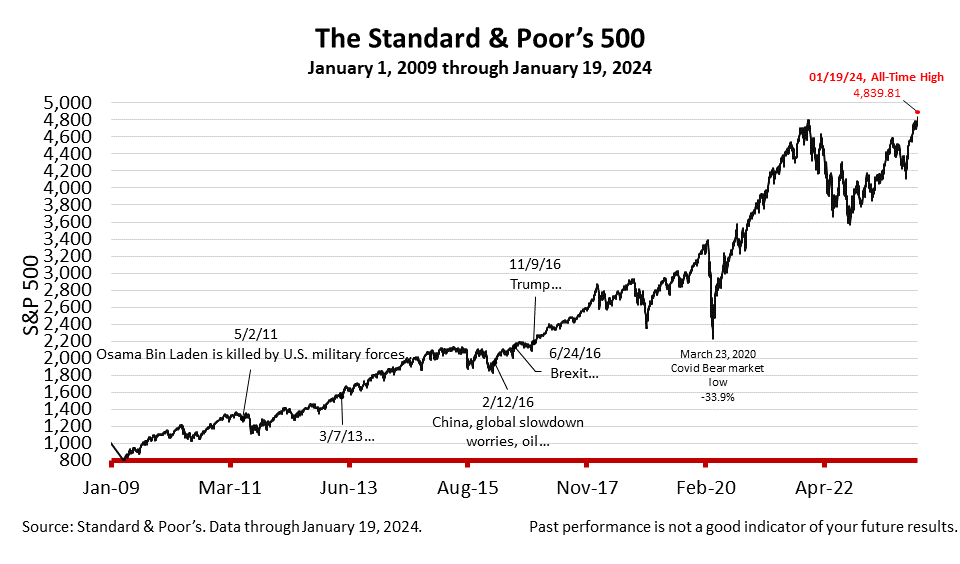

Economic growth drives corporate profits and profits drive stock prices. Investors are seeing the economy continue to outperform expectations. That’s why stock indexes broke the high set two years ago.

The Standard & Poor’s 500 stock index closed at an all-time high on Friday at 4839.81, up +1.23% from Thursday, and + 1.17% higher than a week ago. The index is up +116.31% from the March 23, 2020, bear market low.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.