Amid Divergent Data, Here’s What To Know

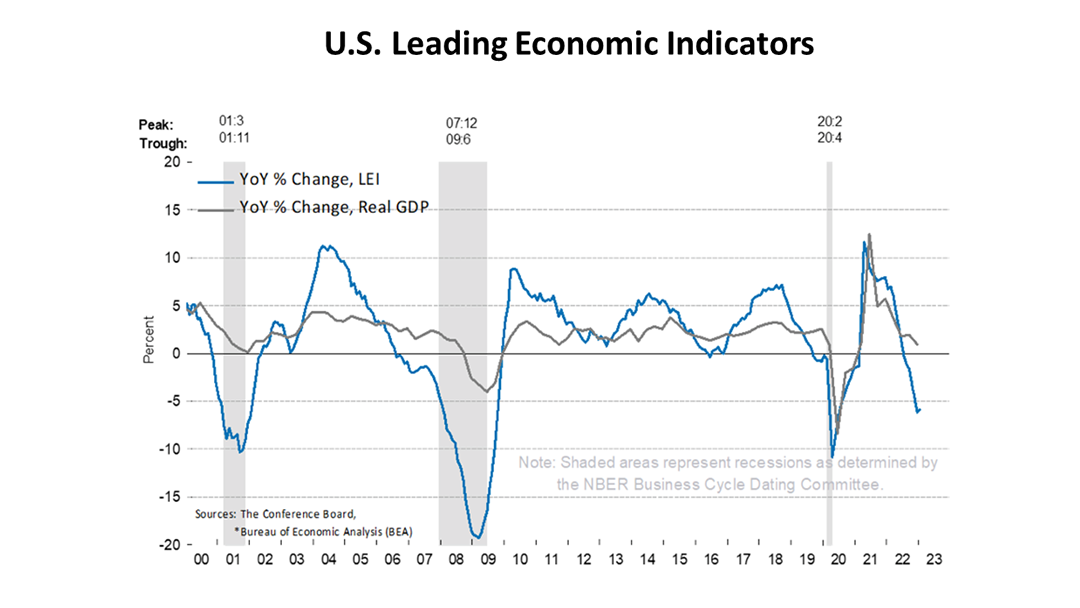

For the ninth straight month, the Leading Economic Index® (LEI) for the U.S. declined in January 2023. According to data released Friday morning, the LEI dropped by three-tenths of 1%, following an eight-tenths of 1% plunge in December. Although the rate of decline in the LEI slowed in January, the collapse of the LEI historically foreshadows recession. The LEI collapsed before every recession in modern financial history except for the Covid-19 recession.

The Conference Board, a big-business group, has calculated the LEI’s 10 sub-component indexes monthly for many decades. On Friday, it reaffirmed its forecast for “high inflation, rising interest rates, and contracting consumer spending to tip the US economy into recession in 2023.”

The Conference Board Leading Economic Index® (LEI) components are:

- average weekly hours worked, manufacturing

- average weekly initial unemployment claims

- manufacturers’ new orders – consumer goods and materials

- ISM index of new orders

- manufacturers’ new orders, nondefense capital goods

- building permits, new private housing units

- stock prices, S&P 500

- Leading Credit Index™

- interest rate spread 10-year Treasury minus fed funds

- index of consumer expectations.

“Among the leading indicators, deteriorating manufacturing new orders, consumer’s expectations of business conditions, and credit conditions more than offset strengths in labor markets and stock prices to drive the index lower in the month,” according to Ataman Ozyildirim, a senior economist at The Conference Board. “The contribution of the yield spread component of the LEI also turned negative in the last two months, which is often a signal of recession to come.”

In June 2022, The Conference Board economics team predicted US gross domestic product growth in 2022 of 2.3%. However, on July 21, 2022, when the LEI declined for a third straight month, The Conference Board reversed its forecast and predicted a “recession around the end of this year and early next (2023) is now likely.”

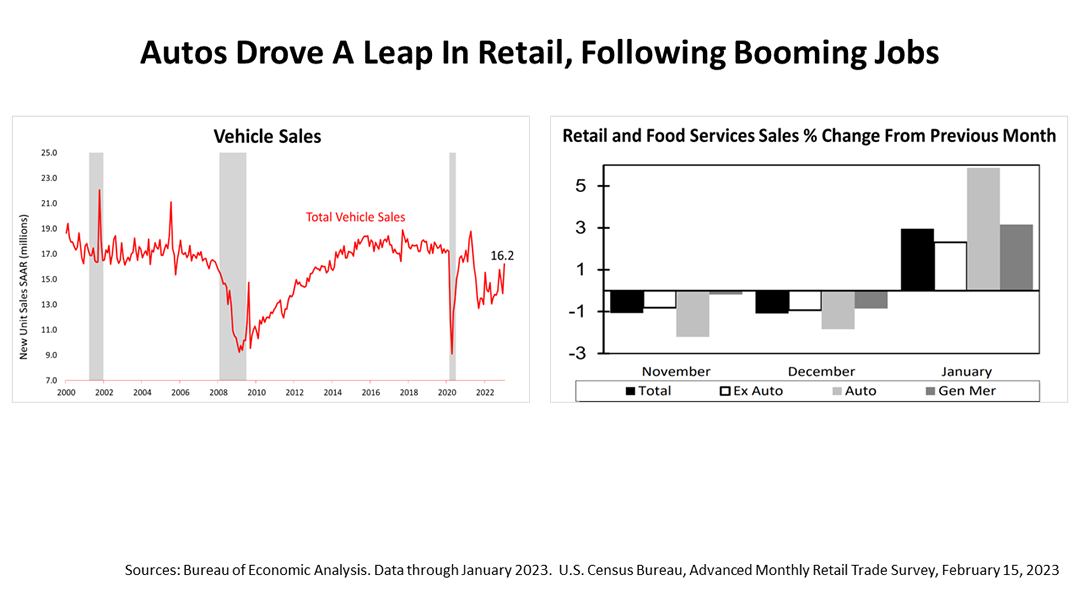

At the same time, car sales leaped in January, according to the latest data. It fueled a sharp rise in January retail sales. To be clear, consumers roared ahead.

This is a strong indicator that a pickup in U.S. growth was under way in January, and it adds to evidence that no recession will occur in 2023, despite the sinking LEI.

The strong retail report follows the Feb. 3 employment report, showing the economy created more than a half-million new jobs in January.

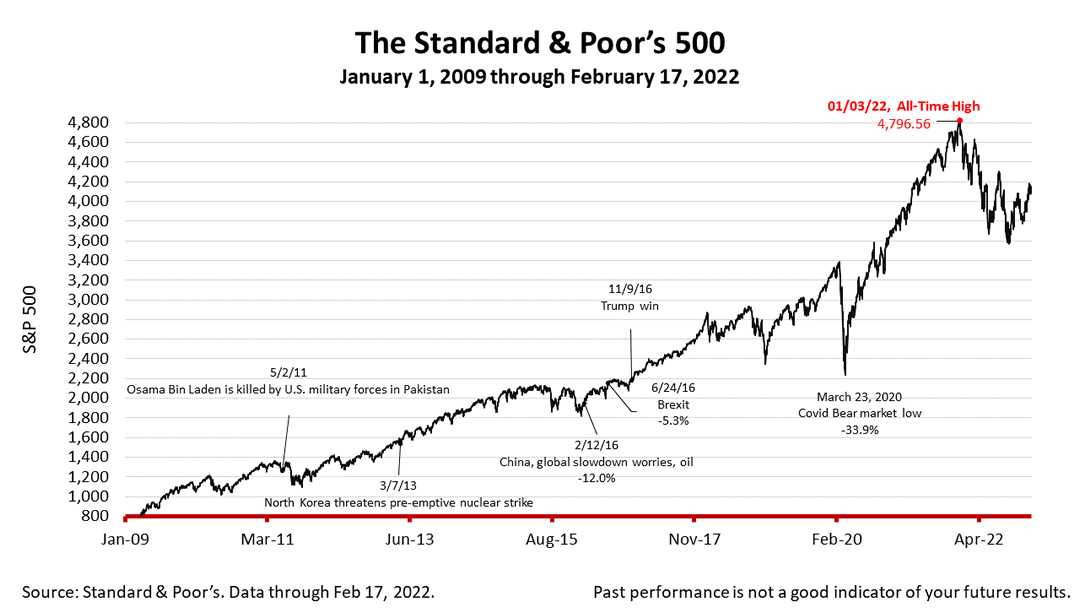

The S&P 500 stock index closed Friday at 4,079.09, down -0.28% from Thursday, and down -0.27% from a week ago.

The index is up +82.31 from the March 23, 2020 bear market low and -14.96% lower than its January 3, 2022. all-time high.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.