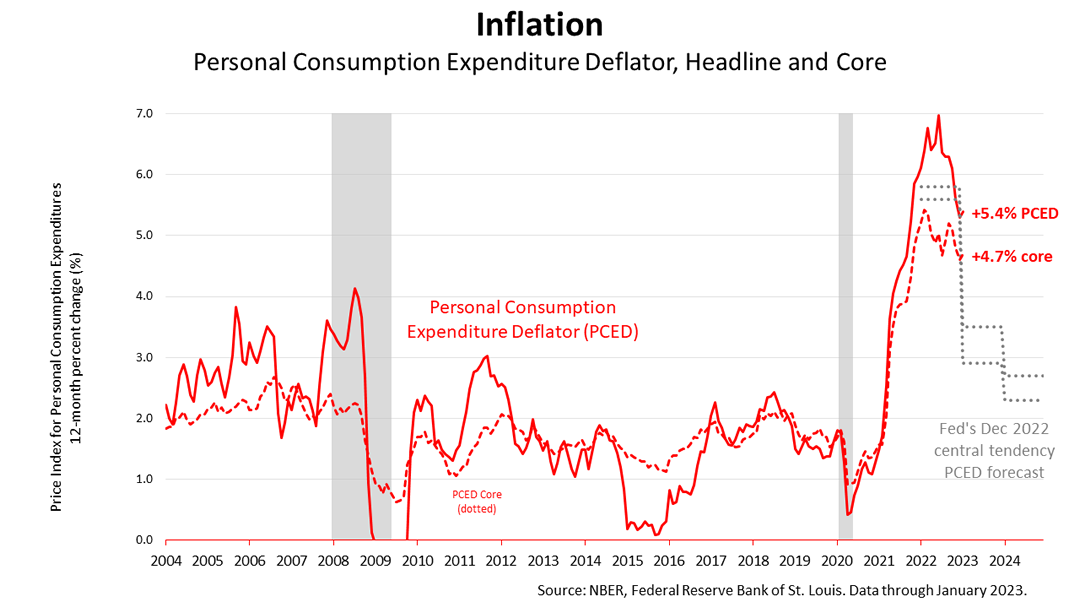

Inflation Rose In January, Indicating Tight Monetary Policy May Continue Into 2024

The 12-month rate of inflation rose in January, according to newly released data. The Personal Consumption Deflator Expenditure (PCED), the inflation index cited by the Federal Reserve in its policy statements, rose to a 12-month rate of 5.4%. The annualized rate of inflation had been expected to decline, but it rose from 5.3% in the 12 months ended December 2022 to the 5.4% annualized rate. It was a disappointment. It means the aggressive monetary tightening campaign begun in March 2022 may be extended.

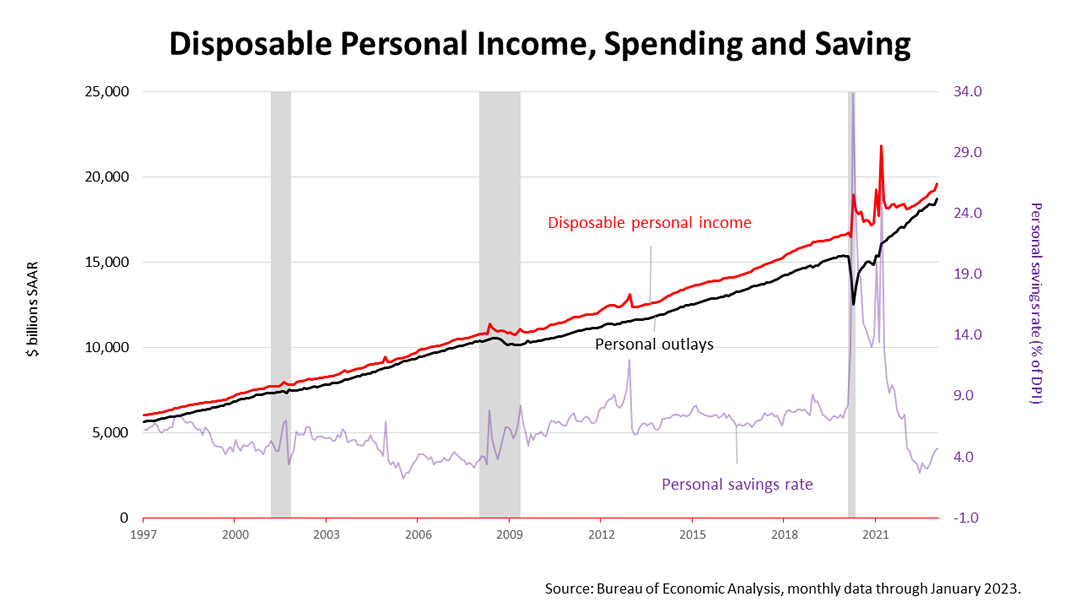

While the inflation news was bad, disposable personal income compared to 12 months ago soared by 8.4%. With inflation at 5.4%, real disposable income was up by 3% in the 12 months through January, and this was good news. Inflation had been outstripping gains in disposable income.

In addition, the savings rate rose sharply, though it is still below the pre-pandemic level.

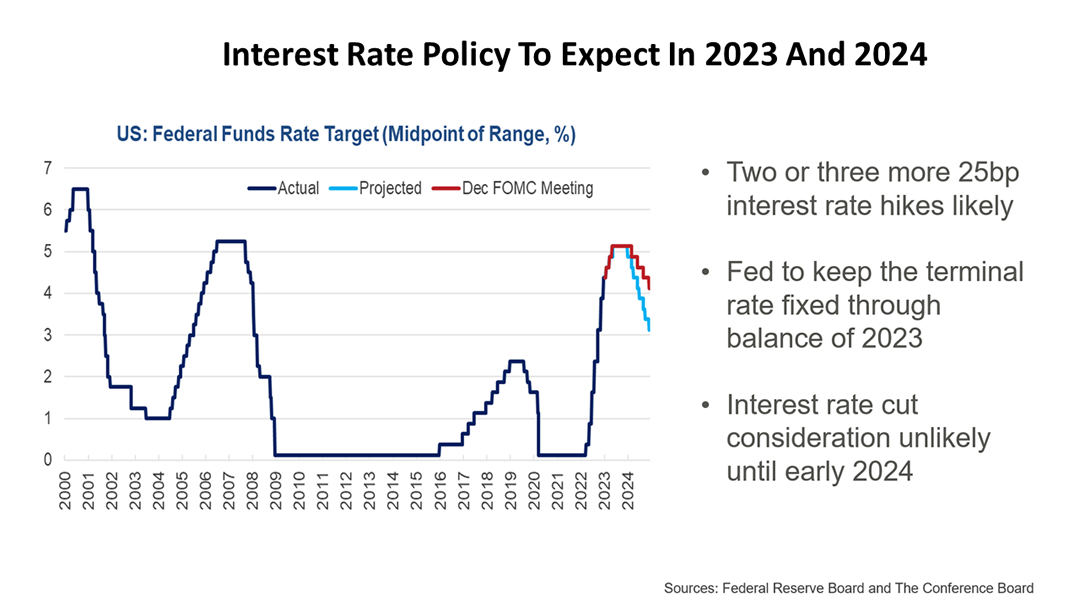

The Federal Reserve has said it expects two more quarter-point hikes in March and May. But Friday’s PCED report opened up the possibility that the Fed may need to hike rates more than that. More or larger rate hikes may be needed to stop inflation. Rate hikes are intended to quash inflation, but they also slow economic growth, increase unemployment and add to uncertainty about when growth will return.

Inflation insidiously undermines the economy if it’s not squashed or if it is even tolerated. So, the stock market may be nervous for the next months.

Dana Peterson, chief economist at The Conference Board, said at a press conference Thursday that the Federal Reserve is unlikely to consider ending its tight monetary policy until early 2024 and the Fed’s 2% target rate for inflation is unlikely to be achieved until the end of 2024.

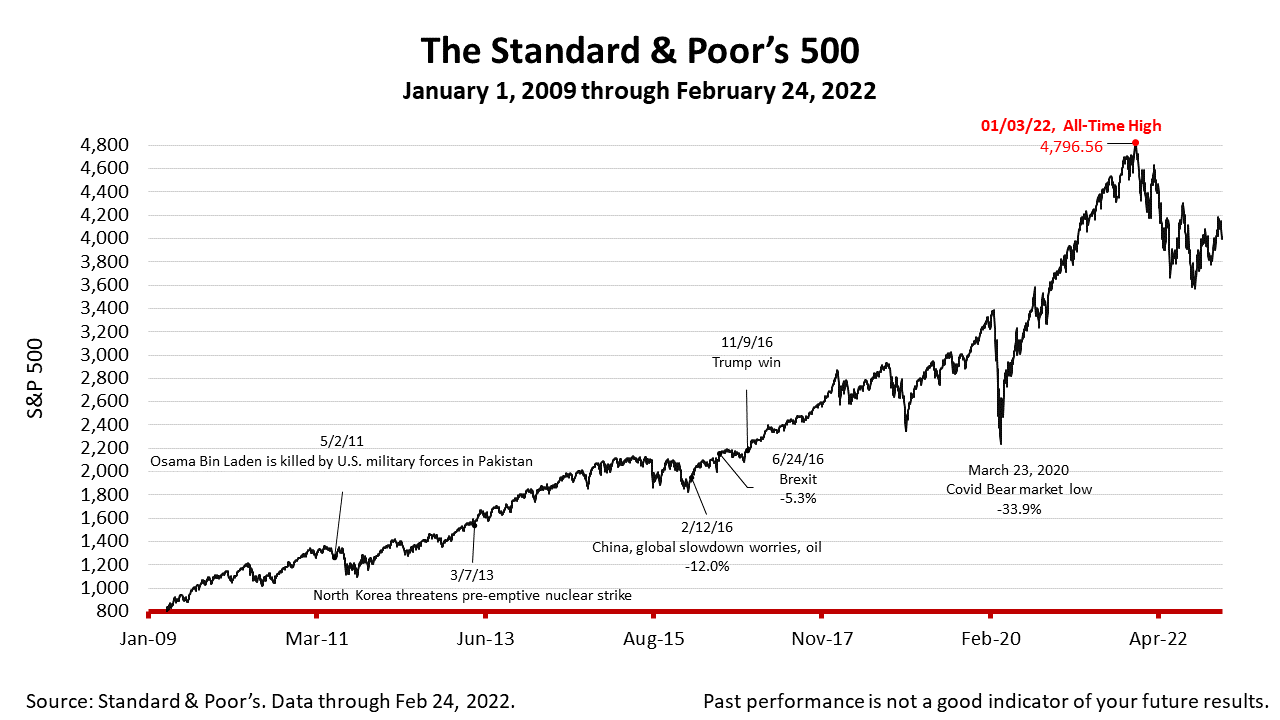

The S&P 500 stock index closed Friday at 3970.04, down -1.05% from Thursday, and down -2.67% from a week ago. The index is up +77.44% from the March 23, 2020, bear market low and down -17.23% from its January 3, 2022, all-time high.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.