Mixed Economic Signals And A Bank Failure

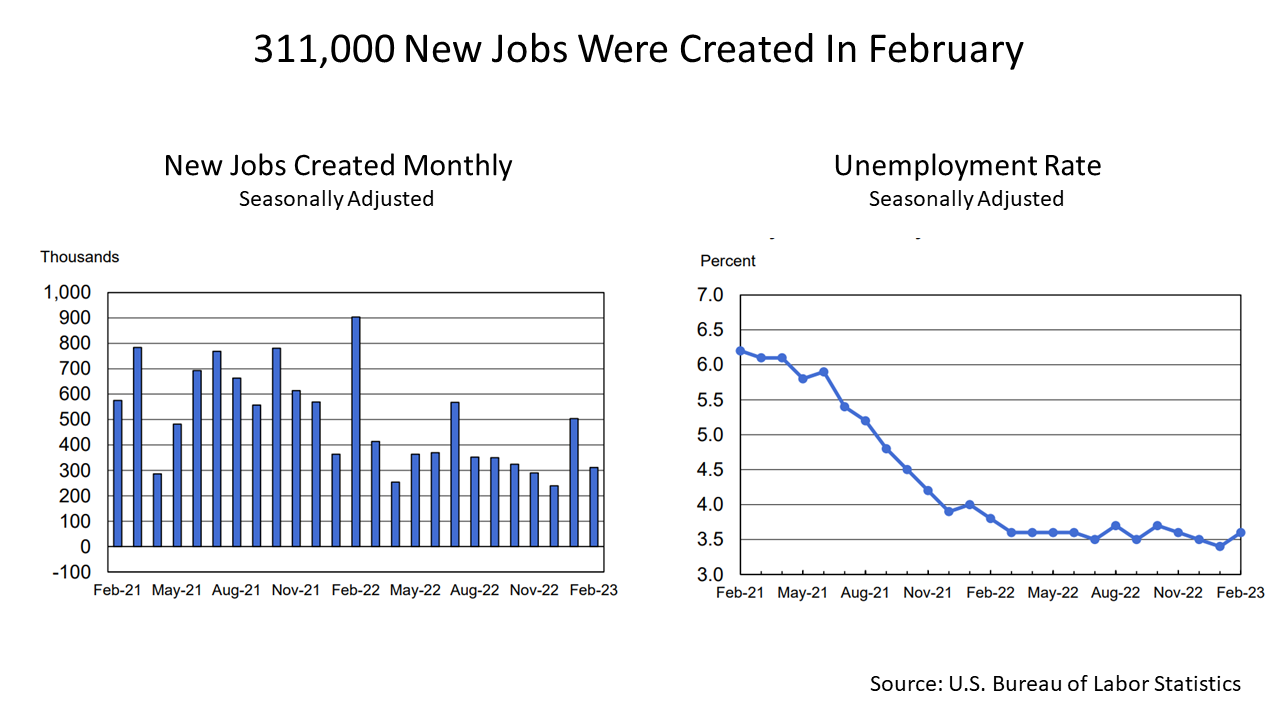

The U.S. economy created 311,000 new jobs in February, exceeding expectations of 225,000, according to the Bureau of Labor Statistics. The unemployment rate edged upward to 3.6%, but remains just above its lowest point in decades.

The February new jobs report was the eleventh consecutive month in which job gains exceeded the expectations of economists. The strong labor market reinforced evidence that no recession was imminent, despite one of the most aggressive monetary tightening campaigns in U.S. history and other signals recession – two quarters of shrinking in the size of the economy — could yet occur by the end of 2023.

The U.S. Leading Economic Indicators have dropped for nine straight months through January 2023 and the yield curve – the difference in the current yield on a 10-year U.S. Treasury bond and 90-day Treasury bill – is upside down, with short-term fixed income T-bills yielding more than long-term bonds.

The strong negative signals from the LEI and yield curve, two historically reliable forward-looking economic indicators, are contradicted by the strong job market reports. Mixed signals coming from the economy have increased near-term uncertainty about the Federal Reserve’s policy. A 0.5% rate hike at the Fed’s March 21-22 of .25% or .5%, but the half-point rate hike quickly became less likely after Friday’s failure of Silicon Valley Bank (SVB).

Though you may never have heard of it before, SVB was a lender to many of the tech industry’s most successful startups, including Andreesen Horowitz, Shopify, and ZipRecruiter. It’s the second-largest bank failure in U.S. history. It spooked the stock market Friday, after growing uncertainty about the mixed signals on the economy.

The Federal Deposit Insurance Corporation (FDIC) took control of the bank on Friday, and a new bank was formed to replace it, according to The New York Times. SVB’s assets are expected to be sold.

SVB’s financial meltdown was caused by unusual events since the pandemic hit, which boosted tech companies. SVB’s insolvency could befall other tech-industry bankers but is not a contagion that is expected to spread to banks not concentrated on technology industry clients.

FDIC insures the up to $250,000 in an account. Since SVB were the personal wealth managers to many of the executives at the startups it financed, many of Silicon Valley’s top executives banked there and many of them are likely to have held more than $250,000 at the bank. They may never get back 100% of money held in SVB bank accounts.

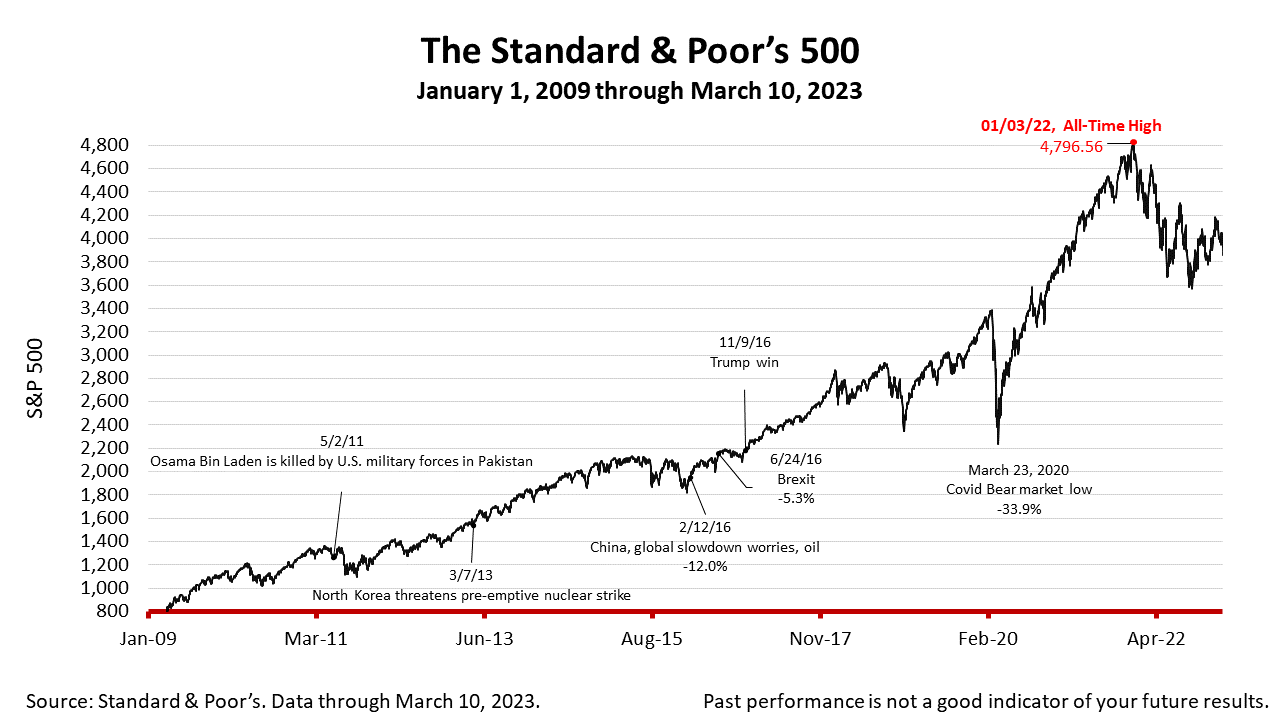

The Standard & Poor’s 500 stock index closed Friday at 3861.59, down -1.45% from Thursday and -4.55% from a week ago.

The growth exhibited by the economy has made Wall Street investors nervous that rate hikes by the Federal Reserve are not slowing economic growth enough to squash inflation. The eight rate hikes since March 2022 represent one of the most aggressive monetary tightening campaigns since the creation of the modern Federal Reserve System in 1913.

The S&P 500 index is up +72.59 from the March 23, 2020, bear market low and down -19.49 from its January 3, 2022. all-time high.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.