Inflation Update for Investors

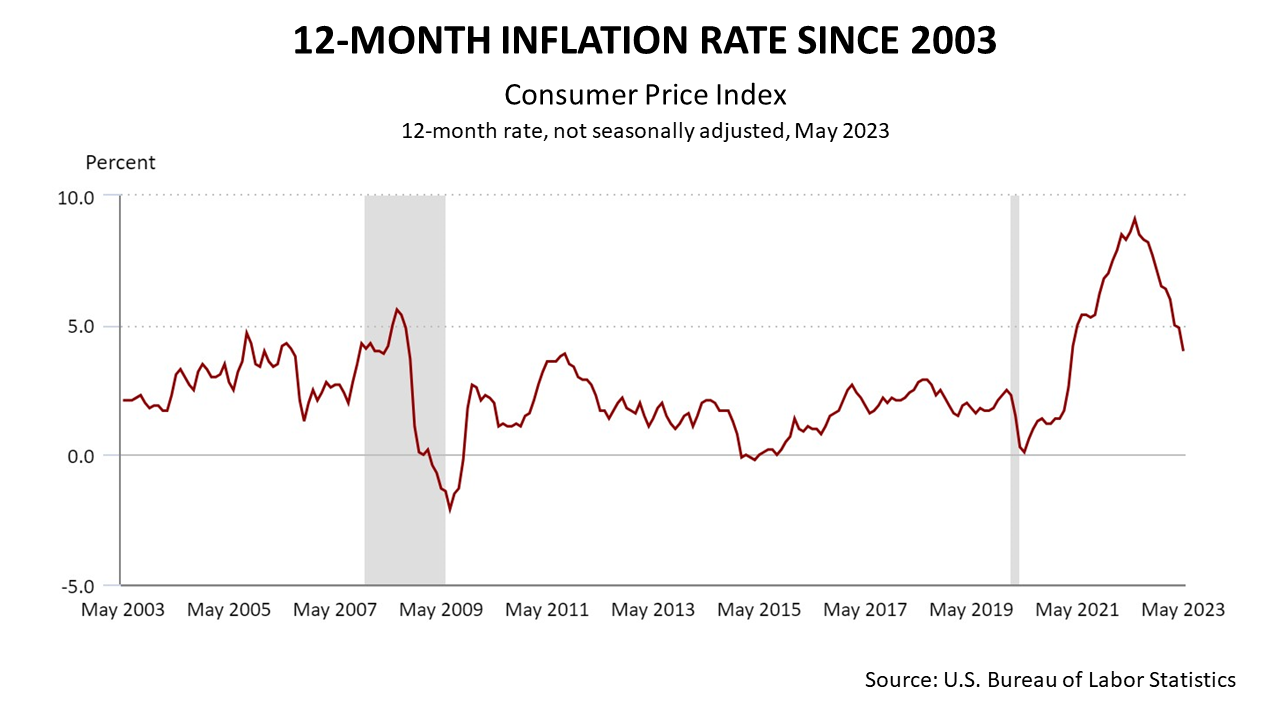

Inflation, as measured by the Consumer Price Index, rose a scant 0.1% in May on a seasonally adjusted basis, and the Federal Reserve may be done with raising interest rates, while economic growth is stronger than expected. The list of bullish fundamentals is much longer than the list of bearish signals, and a turning point in the outlook could be taking hold.

After increasing 0.4% in April, the U.S. Bureau of Labor Statistics reported on Tuesday, June 13, 2023, the fractional level of inflation in May confirmed the Fed had wrung inflation psychology from the mass financial psyche.

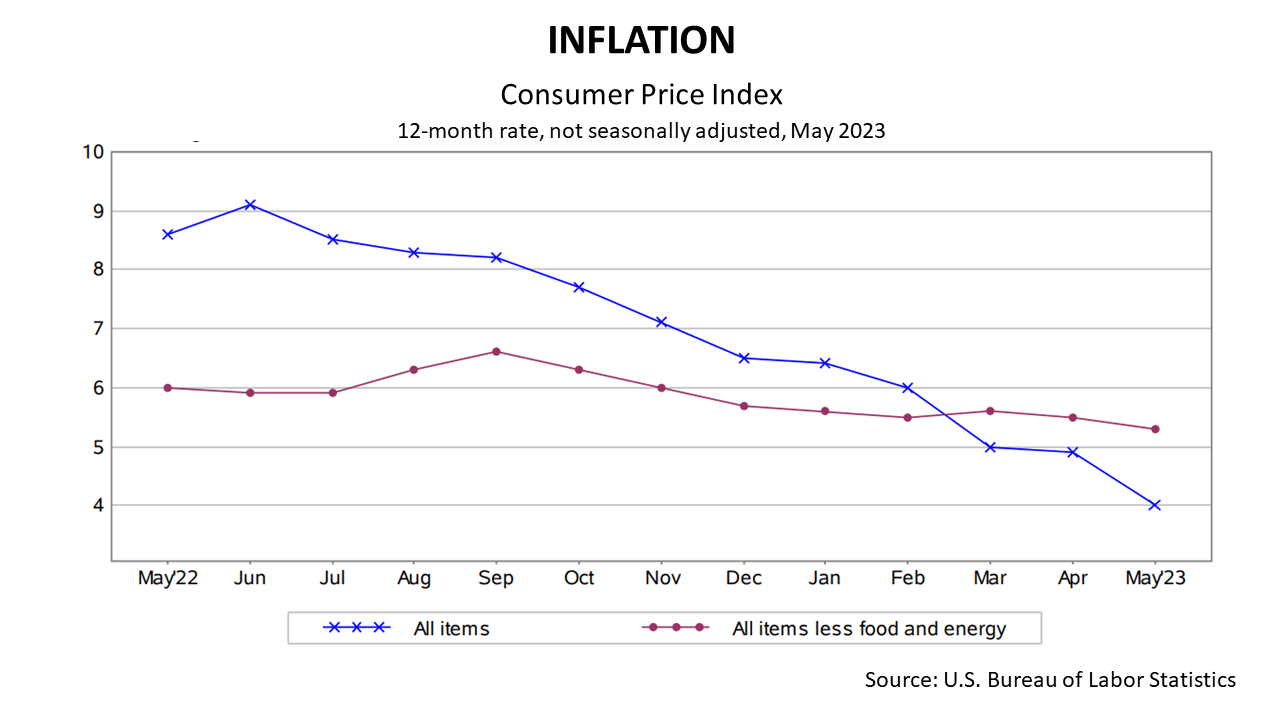

In addition to May’s fractional inflation increase, the 12-month rate of inflation through May also showed progress. The inflation rate in the 12 months through May was 4% before seasonal adjustment. That’s five percentage points lower than the peak 12-month CPI rate of 9.1% reached in June 2022.

The other very good news this past month came on Wednesday, June 14, when the Federal Reserve concluded its meeting by not raising lending rates for the eleventh time since March 2022. In one of the boldest monetary tightening campaigns by the U.S. central bank in its 110-year history, the Fed raised its benchmark lending rate by 1000% in the past 15 months to beat down the worst inflation flareup in over four decades. The Fed said further rate hikes may be necessary, but it could be posturing. With inflation in May of .1%, the Fed might not need to raise rates further. The upshot is that no inflation is on the horizon and the central bank’s rate-hike campaign is done.

The good news on inflation and monetary policy tops a long list of bullish fundamentals. While the Leading Economic Indicators have declined for 13 consecutive months and the yield curve has been inverted all year, these two usually reliable early signals of a recession appear to be misfiring. The long list of bullish versus bearish fundamentals illustrates the mounting evidence that a new economic expansion is underway.

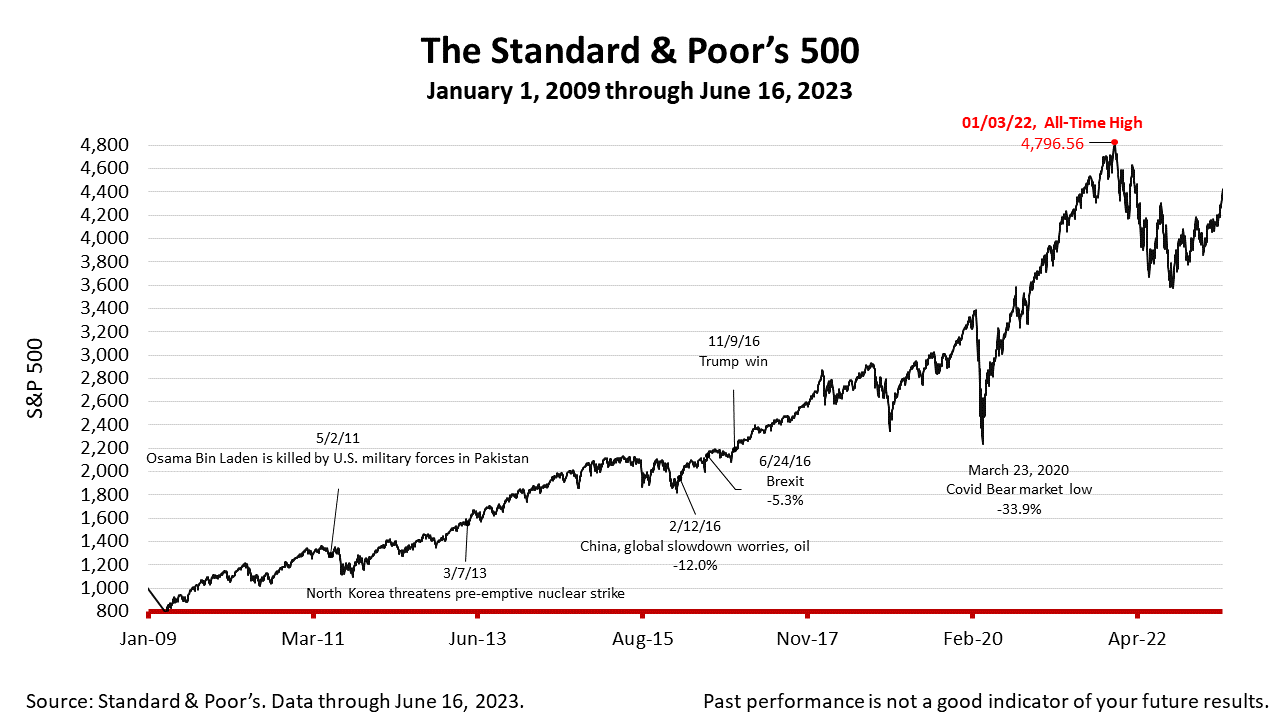

The Standard & Poor’s 500 stock index closed Friday at 4409.59, down -0.37% from Thursday, but surged by +2.58% from a week ago. It was the fifth straight week of gains for the index, which is up +97.09% from the March 23, 2020, bear-market low. The S&P 500 is still -8.07% lower than its January 3, 2022, all-time high.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to the accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.