An Economy Goldilocks Would Definitely Live With

With the economy stronger than expected and inflation cooling fast, it’s a Goldilocks economy, and the outlook for 2024 is brightening.

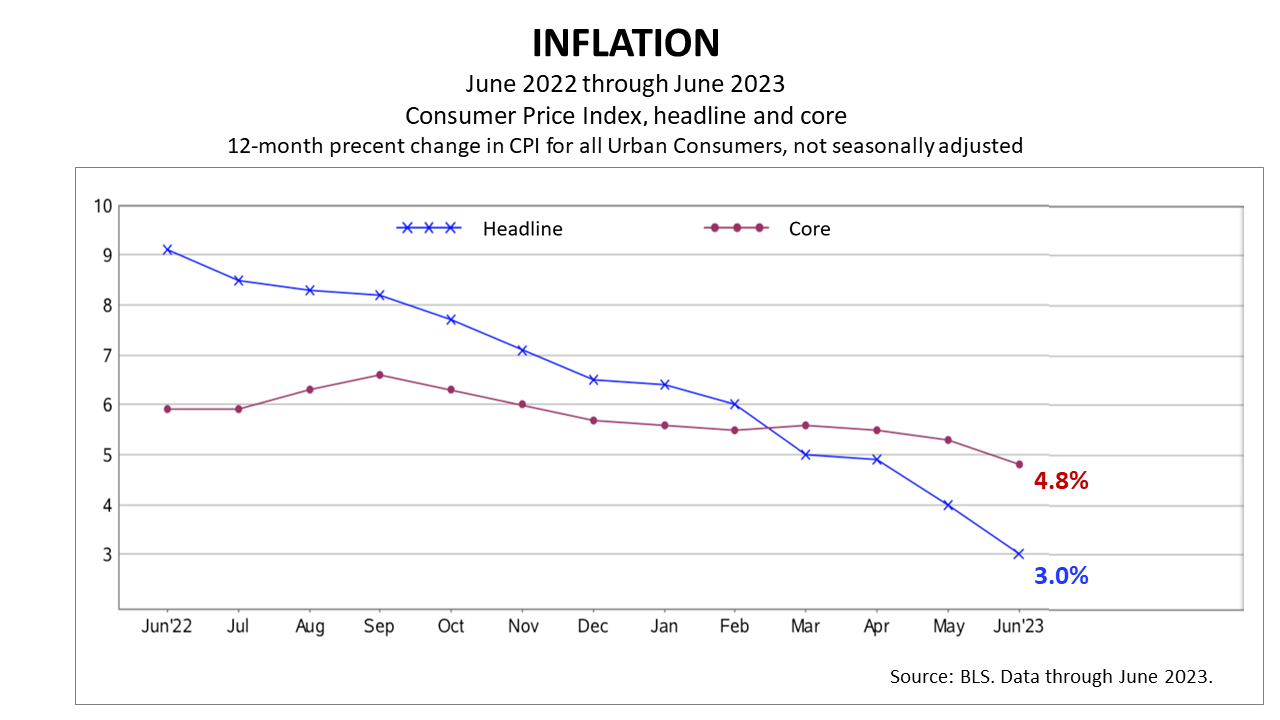

The 12-month rate of inflation plunged again in June, as measured by the Consumer Price Index. CPI measures inflation based on prices of a fixed basket of monthly household expenses. The Headline 12-month rate of inflation – the rise in the cost of all the items in the fixed basket household expenses — declined to 3% from 4% in May. It was the second month in a row in which the 12-month rate of inflation declined a full percentage point.

The 12-month Core Inflation rate, which excludes oil and food prices from the basket of goods because they fluctuate month to month, declined too, to 4.8%. Core inflation tends to lag the headline rate.

Meanwhile, all quarter long, the economists surveyed by Blue Chip Economics have raised their growth expectations.

The average growth rate projected for the second quarter by 10 economists surveyed on July 5, 2023, was 1.3%, while the GDPNow algorithmic-driven forecast on July 10 projected a quarterly rate of gross domestic product growth for Q2 2023 of 2.3%.

The 2.3% growth rate projected for the second quarter, which ended June 30 but is not released until late July, is much higher than expected. As recently as April 6, the consensus forecast of economists was for the economy to shrink slightly.

Since the pandemic, the GDPNow algorithm-driven forecast has been more accurate than the human forecasters polled by Blue Chip Economics. The GDPNow forecast has also been more accurate since the pandemic than the survey of 60 economists conducted quarterly by The Wall Street Journal.

The GDPNow forecast is sponsored by the Federal Reserve Bank’s District Branch in Atlanta. The GDPNow forecast is updated throughout every quarter. The same day new monthly data on manufacturing, jobs, inflation, and other economic fundamentals are released and GDPNow’s forecast is updated. The government officially announces the rate of second quarter growth on July 27, in the first of two estimates before the final GDP growth rate is announced at the end of September.

A 2.3% growth rate would be a very positive surprise, considering the sharp progress on inflation. It means the economy is in for a soft landing or no landing at all.

The Standard & Poor’s 500 stock index closed Friday at 4505.42, down -0.10% from Thursday, and up +2.42% from a week ago. The index is up +101.37% from the March 23, 2020, bear market low and -6.07% lower than its January 3, 2022, all-time high.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock’s weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Financial Services for Real People

Founded for the benefit of clients, Prism Capital Management is an independent Seattle and Skagit-based firm with a deep commitment to providing guidance that is free of conflicts of interest, based solely on the sum of our experience and expertise. We are committed to putting client interests first and to stewarding both wealth and well-being for those we serve. We have a singular measure of success: the results we get for our clients.

As an Investment Advisor, we have a fiduciary duty to act in YOUR best interest. From planning to investment management to advice on buying a car, we are your financial life partners.